Classification of Agents on the basis of extent of authority

The agent is only a connecting link between the principal and the third party and is rightly called a ‘conduit pipe’. He can receive payment and can give a valid receipt for the payment received by him. In case he is in possession of goods or documents of title with the consent of his principal, he may in the ordinary course of business, sell, pledge or otherwise dispose of the goods. The principal is bound by the acts of the agent, provided the third party acted in good faith and bona fide and has no knowledge of the defect of authority of the agent. Though there may be situations where acting on one’s behalf and following their guidance is not reasonable or legal, the agent may have recourse to not follow instruction.

An agent is always tasked with acting with care and competence when handling affairs of the principal. The standard is often held that the agent must act as the principal would, using discretion as if it would incurring the personal gain or loss. Though the level of care may not be explicitly defined, the level of care should be equal to what is reasonably expected by local standards. Agents often have expertise in a specific industry and are more knowledgeable about that industry’s ins and outs than the average person. For example, if you started gaining attention as a musician, you would hire a music agent to help guide you through getting a record deal, signing record contracts, and arranging your touring schedule. An “agent” is a person employed to do any act for another, or to represent another in dealing with third persons.

The person for whom such act is done, or who is so represented, is called the “principal”. If he so elects, it will have the same effect as if the act was originally done by his authority. In other words, the agency is taken to have come into existence from the moment the agent first acted and not from the date of the principal’s ratification. The rule is that every ratification relates back and is equivalent to a previous command or authority. Where an agent does an act for his principal but without knowledge of authority, or where he exceeds the given authority, the principal is not held bound by the transaction. However, Section 196 permits the principal, if he so desires, to ratify the act of the agent.

From there, you will need to decide what insurance products you would like to sell to clients. When acting on behalf of another, an agent must ensure they do not unjustly benefit from their agency position. This includes receiving large benefits from the relationship or taking advantage of their position to ensure classification of agents they receive benefits that would not normally as part of a normal transaction. An agent, in legal terminology, is a person who has been legally empowered to act on behalf of another person or an entity. An agent may be employed to represent a client in negotiations and other dealings with third parties.

Agency of Necessity (Section

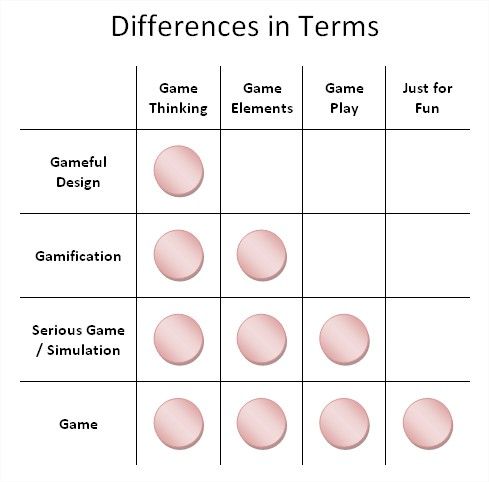

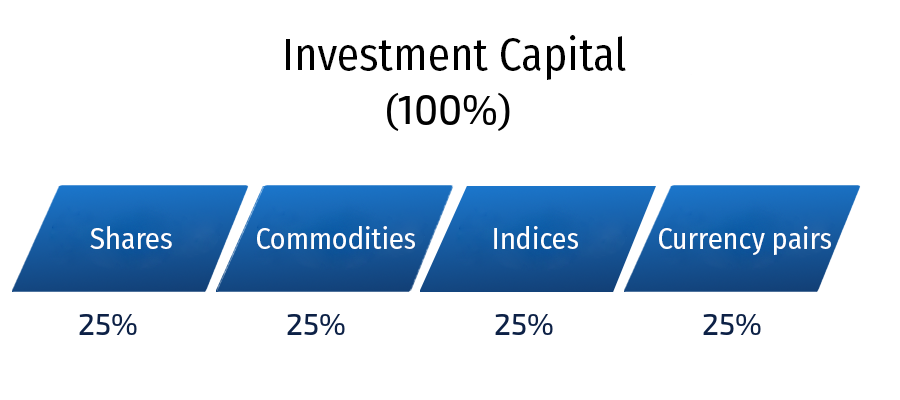

On the basis of extent of authority, the agents may be classified as Agents, General Agents and Universal Agents. An enrolled agent is one that represents taxpayers in front of the Internal Revenue Service (IRS). To become an enrolled agent, one needs to pass an IRS test that covers individual and business tax returns or through experience by being a former IRS employee.

For some clients, it may not be in their best interest to buy those investments. Therefore, the broker has the duty of care to not sell such products to those individuals, sacrificing personal gain to uphold the sanctity of the relationship. During the course of an agent’s relationship with the principal, the agent may not disclose confidential information to unrelated parties.

Duty of Transparency

The term «agent» refers to a person or entity who is permitted to act on behalf of another, known as the principal, to execute certain tasks or make decisions. The relationship between the agent and the principal is controlled by agency law, which is a subset of contract law. The agent is “a person, employed to do any act for another or to represent another in dealings with third person”. The person for whom or on whose behalf he acts is called the Principal. For instance, Anil appoints Bharat, a broker, to sell his Maruti Car on his behalf.

As New Immunotherapy Resistance Definitions Take Shape … – AJMC.com Managed Markets Network

As New Immunotherapy Resistance Definitions Take Shape ….

Posted: Mon, 07 Aug 2023 16:09:27 GMT [source]

For example, imagine if an agent was tasked with shipping specific goods to an agent’s manufacturing warehouse. The agent could obtain information related to the principal’s operations that the agent could then use for its personal benefit. This is especially true when an agent is paid to perform a task on behalf of the principal. For example, a real estate agent commonly receives a commission for their work in selling a house. People hire agents to perform tasks that they lack the time or expertise to do for themselves. Investors hire stockbrokers to act as middlemen between them and the stock market.

What Is an Enrolled Agent?

Implied agency arises from the conduct, situation or relationship of parties. Implied agency, therefore, includes agency by estoppel, agency by holding out and agency of necessity. The acts of the agent, within the scope of the instructions, bind the principal as if he has done them himself. The phrase ‘Qui facit per alium facit per set contains the principle of agency, which means, he who does through another does by himself. In simple words, the act of the agent is the act of the principal. Agency by necessity is most often executed in times of emergency or urgency when the primary party is not available to make a decision.

Of course, the principal can recover his loss from the auctioneer in the above case. Further, an auctioneer has no implied authority to make a private sale, even at a higher price than the reserve price, if the auction sale does not materialize or proves abortive, i.e., fails. There is also «agency by necessity,» in which an agent is appointed to act on behalf of a client who is physically or mentally incapable of making a decision. Business owners, for example, might designate agents to handle unexpected issues that occur in their absence.

Consider the example of Los Angeles Dodgers’ player Freddie Freeman. Freeman’s agent reportedly did not disclose to Freeman that his former team, the Atlanta Braves, wanted to re-sign him. By withholding such information, Freeman reluctantly signed with a different team.

Types of Agents

To become a real estate agent, you need to obtain a real estate agent license. There are a few qualifications for this, and they can vary from state to state. In general, a person needs to be 18 years of age, be a legal resident of the U.S., complete the required relicense education, and pass the real estate exam.

- It simultaneously means the principal is bound (normally) by what the

agent does, since� the

agent is acts as if the principal were there him/herself. - An agent may be employed to represent a client in negotiations and other dealings with third parties.

- However, Section 196 permits the principal, if he so desires, to ratify the act of the agent.

- A special agent is a person appointed to do some particular act or enter into some particular contract.

- For example, if you started gaining attention as a musician, you would hire a music agent to help guide you through getting a record deal, signing record contracts, and arranging your touring schedule.

A real estate agent, securities agent, insurance agent, and travel agent are all special agents. As its name implies, a special agent is appointed to perform a special act or for a specific purpose or to represent his principal for a specific transaction, like selling a car or selling a house. His agency is limited to that particular act and is terminated after the transaction is over. Thus the third party is under an obligation to correctly ascertain the extent of his authority, otherwise the principal will not be bound by any other act of the agent.

Generally, in a business relationship, the principal and

agent relationship requires being either an employee/employer relationship or an

independent

contractor. He is merely a connecting link between the engager and a third party. The usual method of dealing by a broker is to make entries of the terms of contract in a book, called the memorandum book and to sign them. This arises where there is no express or implied appointment of a person as agent for another but he is forced to act on behalf of a particular person. For instance, if a person is employed to purchase a car, the authority of such a person comes to an end as soon as he purchase a car.

Contract of Agency: Types, Classification, Duties and Rights

� If an unauthorized agent contracts with a third

party, the principal cannot be held liable on the contract, regardless of

whether the principal was disclosed, partially disclosed, or undisclosed. Where an agent acts either without any authority or exceeds his authority, he is deemed to have committed a breach of warranty of authority in such a case. He will be held personally liable if his acts are not ratified by the alleged principal. The document sent to the seller is called the sold note and the one sent buyer is called the bought note.

Impact of carcinogens on cancer development – Borneo Bulletin

Impact of carcinogens on cancer development.

Posted: Mon, 07 Aug 2023 22:03:15 GMT [source]

If he exceeds his authority, the principal is not liable for such unauthorized acts. A registered agent is an individual that is authorized to accept legal documents on behalf of a limited liability company (LLC). All LLCs require a registered agent and they are legally allowed to accept tax documents, legal documents, government documents, compliance documents, and any other documents pertaining to the LLC.

Loyalty Responsibilities of an Agent

He acts in the name of his principal and has no authority either to deal in his own name or to delegate his authority. A special agents is one who is appointed to perform a special act or represent his principal in some particular transaction. He has no authority to bind the principal in respect of any other act than that for which he is employed. A special agent is a person appointed to do some particular act or enter into some particular contract. A special agent, therefore, has only a limited authority to do the specified act.

If he does anything beyond the specified act, he runs the risk of being personally liable since the principal may not ratify the same. An auctioneer, in the absence of any reserve price, must sell to the highest bidder. However, in case any reserve price has been fixed, then a buyer is bound by that reserve price even if the exact amount of the reserve price was not known to the buyer at the time of sale. But the principal will be bound to the third party by the acts of the auctioneer done within the scope of his apparent authority even if he acts contrary to the instructions given privately by the principal. The duty of care may be complicated when considering the agent’s personal benefit potential. For example, consider a broker that receives a commission for the sale of certain investment products.