This allocation can come in the form of the traditional overhead allocation method or activity-based costing.. The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated (budgeted) overhead costs for the year divided by the estimated (budgeted) level of activity for the year. This activity base is often direct labor hours, direct labor costs, or machine hours.

During the production process, these costs are essential to the development and creation of goods, and you must allocate these expenses to products so that they properly reflect the full cost of producing the good. Manufacturing overhead is a collection of costs that aren’t directly assignable to a product. They’re often shared across different departments or products, which makes them difficult to assign to one specific thing. Other overhead costs may include advertising, office supplies, legal fees, and insurance.

What Do You Mean by Overheads?

If one product produces 90% of the finished goods quantity, the costs are allocated $900 to $100. If you choose to allocate evenly to each item, the allocation is $500 for each one. With the method chosen above, the dollar amount assigned to each item changes based on the cost driver. It’s easy to track the costs of raw materials, but what about all of those overhead expenses that don’t really belong to a particular product? It’s tough to say just how much electricity you use to run your manufacturing equipment or how much rent should go toward a particular product.

- In addition, some costs are variable (such as direct materials and direct labor) and some are fixed (most of the factory overhead costs).

- As shown in this figure, the total cost you need to apply (in this case, $2,000) equals the total cost that you apply to your products (again, $2,000).

- By using a consistent method of allocating those overhead costs, you can make sure you account for them and create smart pricing strategies.

- However, you can enlarge the overhead base for your firm’s projects by including certain direct or reimbursable expenses in the base, along with direct labor or revenue.

- Once you’ve categorized the expenses, add all the overhead expenses for the accounting period to get the total overhead cost.

Manufacturing overhead is all of the costs that a factory incurs, other than direct costs. Tracking direct labor and materials that have been used in a job can be done with a fair degree of precision. They are the result of many small activities which result in costs being incurred over a period of time but cannot be directly traced to any specific cost object. Job order costing uses the following system to allocate these overheads amongst jobs.

Allocating Manufacturing Overhead Via Departmental Machine Hours

They schedule an engineer for six hours on Job 110 and three hours on Job 210. Again, if Job 110 didn’t exist, six hours never go to payroll — they’re a direct cost to Job 110. Whichever job the engineer works on, however, Build-It Construction still has to pay health care premiums for that engineer. Companies must accurately determine the costs of their products and services to make sound management decisions.

- So, for every dollar in direct labor she pays to the college students, she will allocate $3 in Factory Overhead.

- This includes the costs of indirect materials, indirect labor, machine repairs, depreciation, factory supplies, insurance, electricity and more.

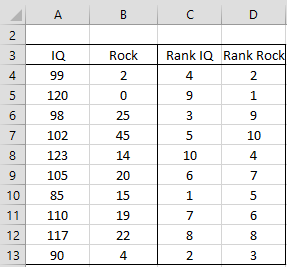

- A consumes 10 hours of direct labour, B consumes 20 hours and C consumer 30 hours.

- However, you can add finer-grain complexity by allocating only a set portion from each overhead G/L account or by allocating a greater or lesser proportion to certain G/L accounts.

- It is often difficult to assess precisely the amount of overhead costs that should be attributed to each production process.

- For instance, if your client owns Bubbles Bubblegum Company, the cost of ingredients, labour to make the gum, and the machinery that makes the gum are manufacturing overhead costs.

For example, say your business had $10,000 in overhead costs in a month and $50,000 in sales. For example, suppose a similar company plans to make two products, Product J and Product K. It plans to pay $1,600 in direct labor to its workers. Product J requires 120 hours of that direct labor, while Product K requires 40 hours. The company also expects to pay $200 for rent, $150 for maintenance, and $50 for coffee. On the one hand, there’s excellent general-purpose accounting software that can work very well for small contractors.

How to Calculate Overhead Rate per Employee

For instance, if a particular item costs $540 to produce, but the market price is only $515, the company will lose money and might be better off discontinuing that product. This means that for every dollar of direct labor, Joe’s manufacturing company incurs $1.21 in overhead costs. Determining the manufacturing overhead expenses can also help you create a budget for manufacturing overhead. You can set aside the amount of money needed to cover all overhead costs.

This chapter will explain the transition to ABC and provide a foundation in its mechanics. Once you’ve estimated the manufacturing overhead costs for a month, you need to determine the manufacturing overhead rate. The overhead rate or the overhead percentage is the amount your business spends on making a product or providing services to its customers. To calculate the overhead rate, book value vs. market value divide the indirect costs by the direct costs and multiply by 100. These include rental expenses (office/factory space), monthly or yearly repairs, and other consistent or “fixed” expenses that mostly remain the same. For example, you have to continue paying the same amount for renting office or factory space even if your company decides to lower production for this quarter.

Had the company used a plant-wide rate, the manufacturing overhead rate would have been $33.33 per MH ($500,000 divided by 15,000 MH), instead of $40 for the machining department and $20 for the finishing department. By using departmental rates, products requiring more machine hours in a high-cost department will be assigned a higher cost than would be assigned if using one established plant-wide rate. Products requiring more time in a low-cost department https://online-accounting.net/ will be assigned a lower cost as compared to one plant-wide rate. The overhead cost per unit from Figure 9.4 is combined with the direct material and direct labor costs as shown in Figure 9.3 to compute the total cost per unit as shown in Figure 9.5. Beyond accounting requirements, allocating overhead helps you make decisions for your company, especially pricing. If you base your product pricing only on direct costs, you cut into your profits.

Finding the right fit means, in part, making sure that it’s able to facilitate the method you and your CPA determine is most beneficial for you. When you begin the search for construction accounting software, talk with vendors one-on-one. ” Here’s where thinking through both overhead and G&A types of indirect costs for allocation might become helpful.

Component Categories under Traditional Allocation

Now, Jackie wants to allocate Factory Overhead to the jobs to see if she is making or losing money on these discrete projects. With the help of her managerial accounting friends, she has come up with an initial allocation rate of $3 per direct labor dollar. So, for every dollar in direct labor she pays to the college students, she will allocate $3 in Factory Overhead. Under cost accounting, there is always an «allocation base» that links the overhead costs to the cost object.

Common bases of allocation are direct labor hours charged against a product, or the amount of machine hours used during the production of a product. The amount of allocation charged per unit is known as the overhead rate. Companies also began to create new departments to help manage the changing character of the factories. Production departments such as machining, finishing, and assembling were established. Other departments such as quality control, maintenance, and factory administration were designated as service departments (or production service departments), since these departments served the production departments.

The Factory Overhead account is reduced by crediting it, and that expense amount is moved into the Work in Process (asset) account by debiting it. To see our product designed specifically for your country, please visit the United States site. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

As you’ve learned, understanding the cost needed to manufacture a product is critical to making many management decisions (Figure 9.1). Knowing the total and component costs of the product is necessary for price setting and for measuring the efficiency and effectiveness of the organization. Remember that product costs consist of direct materials, direct labor, and manufacturing overhead. A company’s manufacturing overhead costs are all costs other than direct material, direct labor, or selling and administrative costs. Once a company has determined the overhead, it must establish how to allocate the cost.

CONCEPTS OF COSTING: COST, COST ELEMENTS – COUNCIL OF ENGINEERS AND VALUERS

CONCEPTS OF COSTING: COST, COST ELEMENTS.

Posted: Tue, 15 Aug 2023 07:00:00 GMT [source]

If you have been wondering how to calculate overhead costs, it is simple. You just need to categorize each overhead expense of your business for a specific time period, typically by breaking them down by month. While all indirect expenses are overheads, you must be careful while categorizing them. It is important to research overhead for budgeting and determine how much the business should charge for a service or product to make a profit. For example, if you have a service-based business, then apart from the direct costs of providing the service, you will also incur overhead costs such as rent, utilities, shipping costs, and insurance. Let’s assume a company has overhead expenses that total $20 million for the period.

These could be administrative staff, security, or sanitation employees. Knowing how to calculate your overhead costs is important for reporting your taxes, creating a budget, and identifying areas of excess spending. This article will cover different ways to calculate your overhead costs, helpful formulas, and benefits to calculating your overhead. This also indicates that based on information posted to the ledgers so far, Factory Overhead has been over-allocated by $500.

Let’s say we consider our operation to be labor-intensive rather than capital-intensive (automated). In that case, we might choose to allocate fixed overhead based on direct labor hours (DLH) or direct labor dollars (DL$). If our standard direct labor cost is the same for both purses, these two calculations will produce the same results, so in this lesson, we’ll use DL$. However, if workers producing deluxe purses are more highly paid than workers producing basic purses, the outcome between the two direct labor methods would be different. Until now, you have learned to apply overhead to production based on a predetermined overhead rate typically using an activity base. An activity base is considered to be a primary driver of overhead costs, and traditionally, direct labor hours or machine hours were used for it.