Post-Closing Trial Balance Entries & Examples What is a Post-Closing Trial Balance? Video & Lesson Transcript

Content

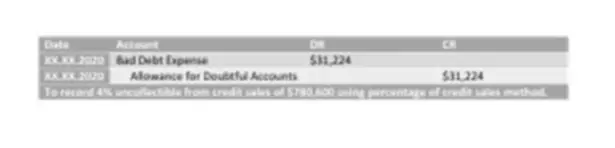

Generally, this should include the name of the company, the type of trial balance, and the date of the report. The first method is the allowance method, which establishes a contra-asset account, allowance for doubtful accounts, or bad debt provision, that has the effect of reducing the balance for accounts receivable.

- This measures the credits and debits of your remaining accounts that have a balance and checks to see if they still balance, which is one of the core principles of double-entry accounting.

- Once the adjustments have been posted, you would then run an adjusted trial balance.

- After Paul’s Guitar Shop posted itsclosing journal entriesin the previous example, it can prepare this post closing trial balance.

- There are three types of trial balance – Post-closing, Unadjusted, and Adjusted Trial Balance.

- Each account is closed to a special account called income summary.

We see from the adjusted trial balance that our revenue accounts have a credit balance. To make them zero we want to decrease the balance or do the opposite.

Introduction to Business

It’s important that your Post Closing Trial Balance and all debit balances and all credit balances in your general ledger are the same. If they’re not, you’ll have to do some research to locate the errors. A general ledger is a record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. First, identify the accounts that possess balances, and if closing entries were performed correctly, these should simply be those on your company’s balance sheet. Like all financial reports, a post closing trial balance should be prepared with a heading. Preparing financial statements requires preparing an adjusted trial balance, translating that into financial reports, and having those reports audited.

Oregon outdoor rec ski resorts Legislature takes up liability bill – Statesman Journal

Oregon outdoor rec ski resorts Legislature takes up liability bill.

Posted: Wed, 15 Feb 2023 14:07:30 GMT [source]

Your stockholders, creditors, and other outside professionals will use your financial statements to evaluate your performance. If you evaluate your numbers as often as monthly, you will be able to identify your strengths and weaknesses before any outsiders see them and make any necessary changes to your plan in the following month. All temporary accounts with zero balances were left out of this statement. Unlike previous trial balances, the retained earnings figure is included, which was obtained through the closing process. The last thing that occurs at the end of the accounting cycle is to prepare a post-closing trial balance. Once all closing entries are complete, the information is transferred to the general ledger and the post-closing trial balance is complete. The next step in the accounting cycle is to prepare the reversing entries for the beginning of the next accounting period.

Change Management

A https://www.bookstime.com/ is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. The debits and credits include all business transactions for a company over a certain period, including the sum of such accounts as assets, expenses, liabilities, and revenues. Adjusted trial balance – This is prepared after adjusting entries are made and posted. Its purpose is to test the equality between debits and credits after adjusting entries are prepared.